Small business tax reform. It’s a popular rallying cry. “The Washington Examiner” article by Tim Click (below) is one business owner’s reasoned take on the subject. I may not agree with all the author’s points but to elaborate further here would be putting the cart before the horse. Why? Because I don’t believe we can talk reasonably about small business tax reform until we reform how we define a small business.

According to the Small Business Association (SBA) a small business can have up to $7 million in revenues and 500 workers, depending on the industry in which it competes. Really? That covers a hell of a lot of territory. How can such a broad definition be meaningful? According to Forbes Magazine, over 500,000 new businesses are formed in the US each month. Fifty percent of these new businesses will fail within five years. What is causing those failures? My guess is that onerous tax paperwork and excessively high state and federal tax payments are low on the list of contributing factors. Speculation, you say? Not really. Consider that there are small businesses and, then, there are really small businesses.

Nearly 80% of all small businesses in the US are non-employer businesses, self employed undertakings. Their needs are quite different from those of Mr. Click’s firm. Unlike his successful aluminum and stainless electrical conduit business, they do not undertake million dollar capital equipment projects; depreciation schedules/reforms are not really a concern. Yet, many of these tiny businesses represent future employers, future job creators. Keurig started as a non-employer business. Today, directly and indirectly, Keurig Green Mountain it is responsible for having created many thousands of jobs. What very small and/or self employer businesses most need is not tax reform, it’s ready access to funding.

So, pause a moment the next time someone says something like: “Small businesses, which have generated 65% of all net new US jobs since 1995, desperately need tax reform.” Yes, the job creation numbers are compelling. But, consider that most “small businesses,” however large they may be today, likely started with limited resources. When these businesses were most vulnerable, their most pressing needs did not include tax relief.

So, yes, we should consider tax relief for businesses like Patriot Aluminum Products, just don’t categorize those businesses as small. It’s time to come up with a better definition of a small business. . . and a better way to fund them.

Entrepreneur Mentor and Startup Quarterback | Startups + Small Businesses + Home Businesses.

Specialties – Strategic Planning | Web Design | Digital Marketing|

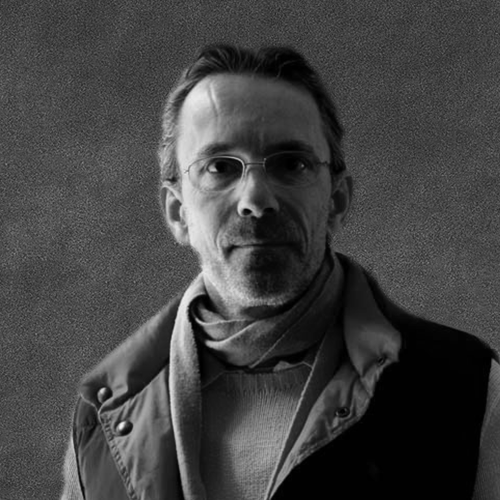

Hans van Putten owner of 40parkLane,llc ran operations of his food manufacturing company for 17+ years building the Carolyn’s Handmade brand under the umbrella of 40ParkLane,llc.

After the successful sale of the food business, he took advantage of the years of strategic planning, operations management, web design, digital marketing and photography experience , to help startups, small businesses and home businesses and has been involved in a number of start-up ventures since.

Prior to founding 40parkLane,llc Hans worked for the Gillette Company for 10 years in various financial roles of increasingly bigger responsibility, leaving as Director of Business Planning for The International Group at Gillette HQ, Boston. Hans has an MBA (Marketing & International Business) from Aston University, and a BA in Business Administration from IHBO de Maere.